As energy expenses rise and environmental concerns escalate, numerous homeowners are seeking methods to lower their electricity costs and minimize their carbon footprint. With advancements in solar technologies and government incentives for home solar installations, rooftop solar systems are increasingly popular. For those considering transitioning to solar power, various financing options are accessible to homeowners. This article delves into a comparison of the different solar financing choices available to homeowners in the U.S.

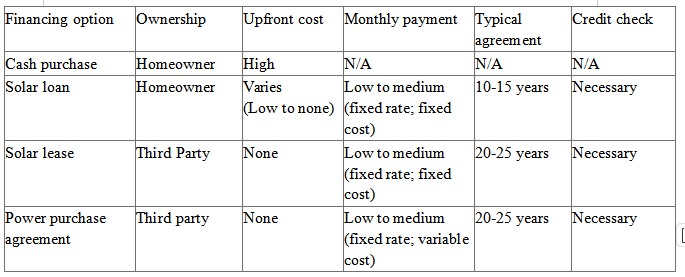

There are several factors to consider when it comes to solar financing, including ownership, initial expenses, credit standing, and more.

Firstly, determine who you want as the owner of your solar system. Opting for self-ownership often yields the best returns, especially if you are eligible for financial aid from federal and local solar incentives, which can lower the system's cost. Additionally, having solar panels installed increases the value of your property.

The typical cost of a residential solar system is approximately $20,000, which is a substantial sum to pay in one go. However, if feasible, this approach provides maximum savings. Another option is to secure a solar loan, eliminating the need for an initial payment while still retaining ownership of the system. It's essential to note that creditworthiness may impact your eligibility for a loan.

If personal ownership is not a priority, you can consider a third-party ownership model using a solar lease or a power purchase agreement. Under this arrangement, a solar financing firm or another third party covers the entire upfront cost and maintains ownership of the system throughout its lifespan. Consequently, any maintenance or repairs become the responsibility of the third party, while you benefit from the sustainable energy produced by the system.

The primary factors of each solar financing option are broken down in the table below:

Cash Purchase

To maximize your savings, consider acquiring your entire solar system outright with a cash payment. By doing so, you effectively secure approximately 25 years' worth of electricity, shielding yourself from fluctuations in electricity rates and granting you energy autonomy - the ability to generate your own solar energy.

Furthermore, you can take advantage of various incentives and rebates available to those who purchase their solar system outright. Incentives such as the federal investment tax credit (ITC) can help offset the initial cost, and net metering programs, which compensate you for exporting solar energy to the grid, enable you to earn additional income from your system over time.

As the owner, you are responsible for any system upkeep and repairs. Nonetheless, with the system fully paid off, you enjoy the benefit of not having regular payments or long-term agreements.

If you prefer ownership but want to minimize initial expenses, you have the option of obtaining a solar loan and gradually repaying the cost of your system. Similar to an outright cash purchase, securing a solar loan grant you immediate ownership of the solar system, making you eligible for solar incentives and utility net metering programs.

Generally, the installment payments amount to less than your monthly electricity bill, but it's crucial to ensure that the loan's interest rate aligns with your long-term budget for system costs. Furthermore, a solid credit history is usually required to qualify for specific solar loans.

Solar loans come in two types: secured and unsecured. A secured loan necessitates an asset (typically your home) to serve as collateral, with interest rates typically ranging from 3-8%. On the other hand, unsecured solar loans, which do not require a property lien, can have interest rates as high as 20%.

In California, Florida, and Missouri, homeowners have access to a distinct solar financing loan model known as Property Assessed Clean Energy (PACE). Through PACE, the repayment of the loan occurs annually through increased property taxes, based on the added value of the solar system. Similar to other loan options, PACE alleviates the burden of the upfront cost and allows for gradual financing of the system. Moreover, it attaches the debt of the system to the property rather than to you as an individual. PACE programs are typically formulated by state legislatures and subsequently authorized by local governments. You can find more information about residential PACE programs here.

Solar leases offer a great option for those who want to avoid the upfront costs associated with purchasing a system. With a solar lease, you make fixed monthly payments for the electricity produced by the system, based on the estimated annual production. These lease agreements typically last 20-25 years, after which you have the choice to buy the system at market value.

Since you don't own the system with a solar lease, you miss out on the benefits of solar incentives like the Investment Tax Credit (ITC) and revenue from net metering programs. This means that your overall savings over the system's lifetime may be lower compared to a solar loan, which allows you to take advantage of the financial benefits that come with ownership.

A power purchase agreement (PPA) is another financing option through a third party, which also means that you cannot receive solar incentives or participate in a net metering program. Similar to a solar lease, a PPA's monthly payments are based on a fixed rate calculated from the system’s estimated energy production.

However, a PPA differs from a solar lease in that your payments will vary from month to month. While a solar lease has consistent monthly payments, regardless of energy consumption, a PPA payment is determined by the kilowatt-hours of energy consumed during that specific period. As a result, you can expect slightly higher PPA payments during months when you use your air conditioner or heater more frequently, such as summer or winter.

PPA agreements typically include annual rate escalators, so your payments may increase over time. However, these increases are often lower than annual utility electricity rate hikes, ensuring long-term savings on your electricity bills.

Solar Financing Options for Homeowners

Going solar is increasingly cost-effective, and homeowners have a variety of financing structures to consider, which balance factors like ownership and upfront costs. To get an estimate of solar costs, use the Pytes System Calculator to estimate the kWh usage of your electricity based on the appliances you plan to power.

Common Questions:

Q: What rebates and incentives are available for solar?

A: Rebates and incentives vary by location and utility provider, with examples including the federal solar investment tax credit (ITC), property and sales tax exemptions, and net metering.

Q: What are my solar financing options?

A: Homeowners can finance solar systems through loans, leases, or power purchase agreements, or choose to purchase the system outright.

Q: Should I buy or lease a solar panel system?

A: Buying a system provides ownership and immediate electricity savings, while leasing allows for avoiding upfront costs with monthly installments, but without owning the system until the lease ends.

Q: Should I choose for solar loans or solar lease?

A: A solar loan offers ownership and eligibility for solar incentives, while a lease can be a better option for those looking for maintenance coverage and regular payments over time.

Q: How do I find the best solar loan?

A: First, define your goals for going solar: immediate savings, maximum savings, low rates, or short payback period. Generally, a secured loan offers lower interest rates, and a higher down payment reduces the overall loan amount.

Q: How can I find a solar installer?

A: Use the Pytes Installer Locator to find reputable installers near you from the Pytes Installer Network, known for customer service and system quality using Pytes products."